Welcome to your weekly update on the performance of Universal/Extended/Alt ID in the European bidstreams.

You’ve been asking us to share universal/extended/alt ID insights to help make decisions about your identity infrastructure today and in the future, so that’s exactly what you’ll get in this tracker. It’s a race to replace third-party cookies before Q1 2025.

Roqad has a front row seat to the European and North American universal ID landscape (among others), and while we can’t speak for every single bid transaction, we have a pretty good view of what is happening.

Click here to sign up to receive alerts for updates

EUROPE

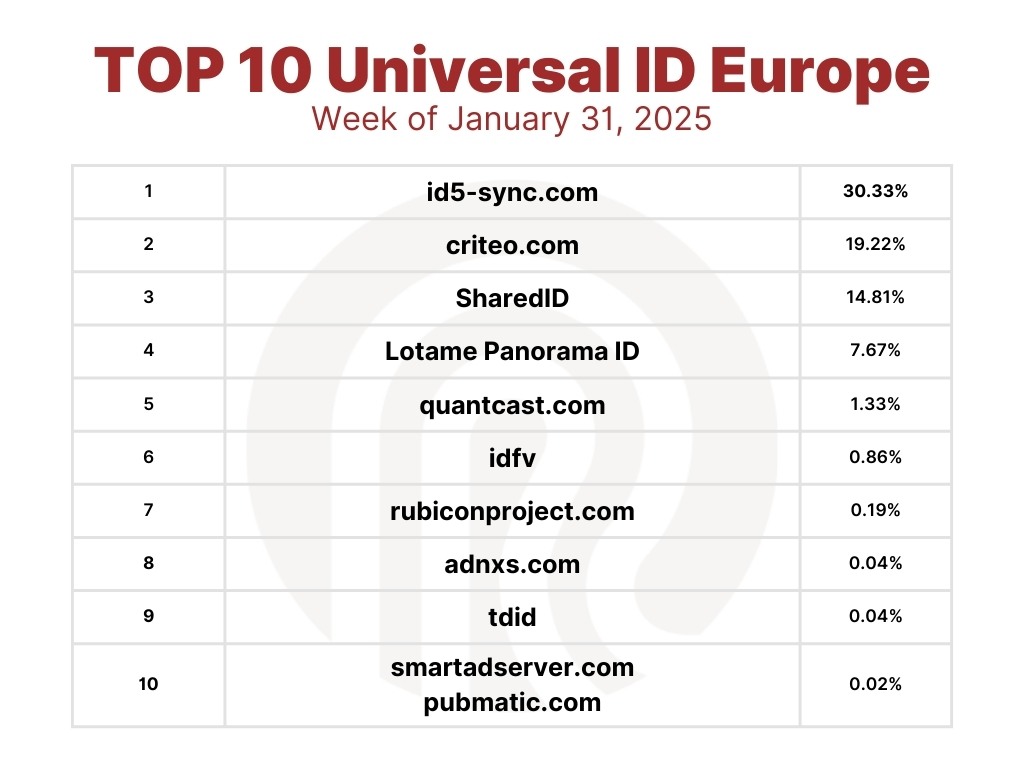

January 31, 2025 release (Week #4)

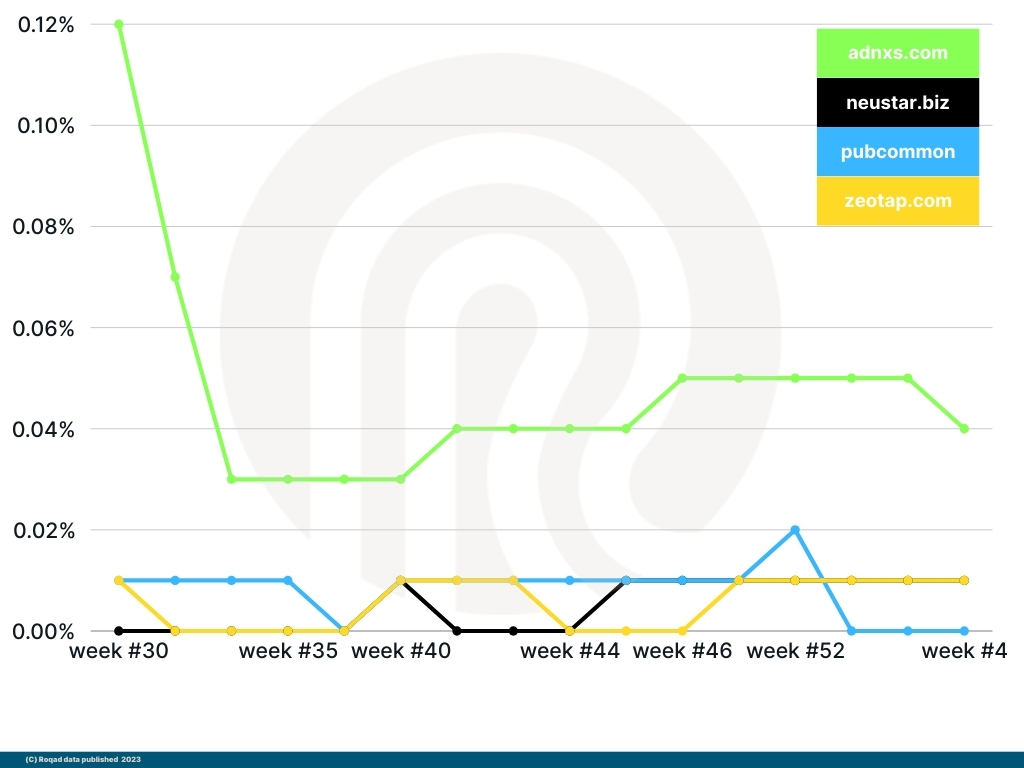

Europe | Group 4: some more of the higher volume IDs (0.01% – 0.10% range)

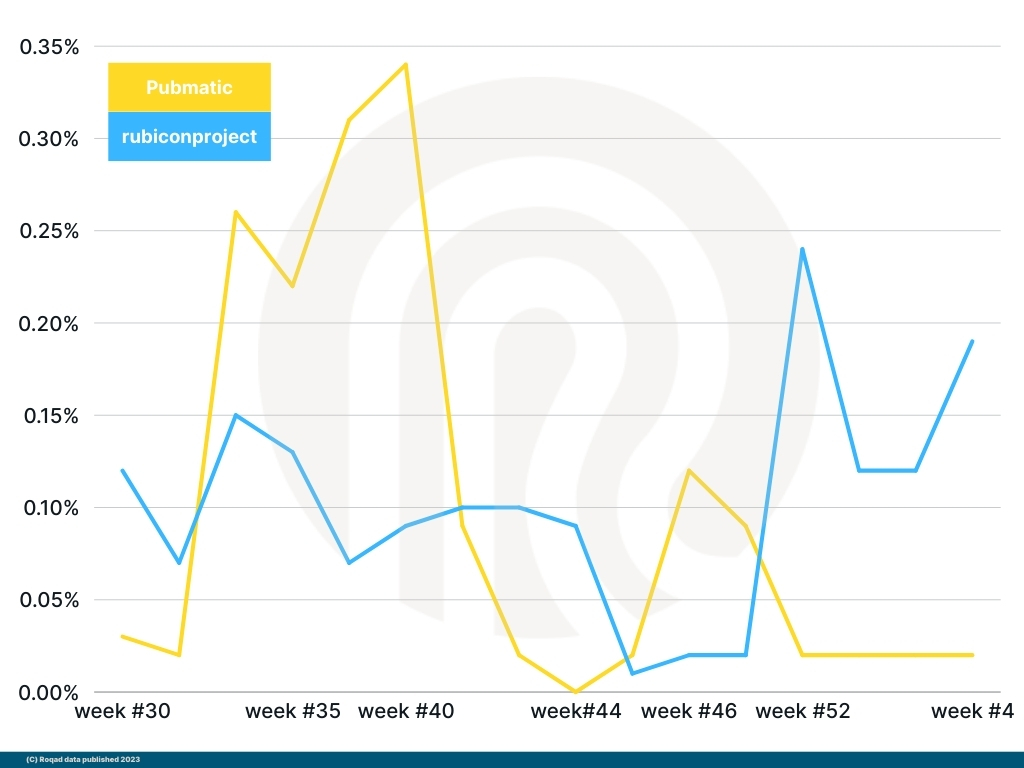

Europe | Group 3: some more of the higher volume IDs (0.05% – 2.0% range)

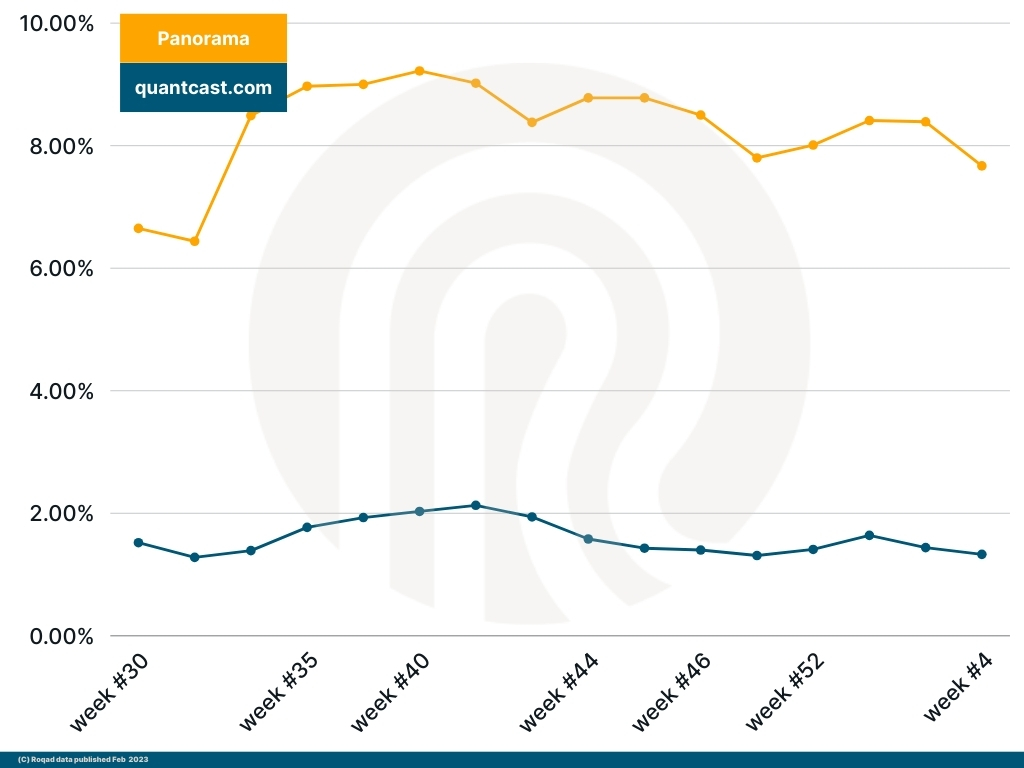

Europe | Group 2: some of the higher volume IDs in (2.0% – 10.0% range)

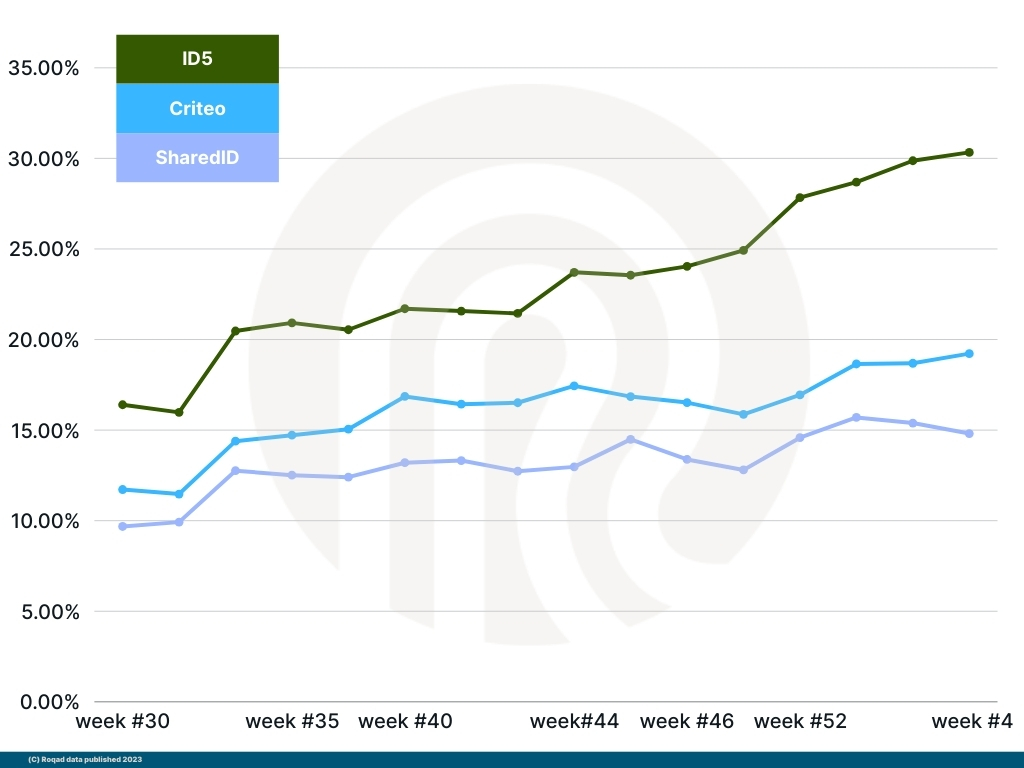

Europe | Group 1: the leaders

Top 10 Universal ID Europe

Universal IDs (also called ‘extended’ IDs or alt IDs) are trending up and to the right. We expect the trend to continue.

- Obviously the deterministic data set is dominated by third-party cookies.

- Note that a Publisher can set 20 third-party cookies per page/per user if they like, and we would see them all in the bidstream.

- Mobile advertising identifiers are limited to one at a time.

- There are more publishers using Prebid (pubcid.org) right now. Prebid allows publishers to use more than one identifier on the same page at the same time.

- Why use several different IDs at once? Big publishers are probably covering their bets to make sure their ad inventory is being used.

- The so-called third-party cookie apocalypse didn’t happen, it’s postponed until the end of 2023, perhaps longer, so identity providers are using third-party cookies and syncs extensively as long as they’re available.

- Yes, third-party cookies are being used to prepare for the cookie apocalypse.

- No one knows who will win the identifier competition. Right now it makes sense to work with several at a time just in case.

- It appears that the publisher ID problem in mobile is not being solved with a single or small group of universal IDs.

- identityLink is operated by LiveRamp.

- Re: the “Britepool” ID. Britepool merged with bigtoken.com in 2021. Apparently they kept the original Britepool ID name. BigToken actually has an interesting product concept. From their website: You can use the BIGtoken application to manage your digital data and identity and earn rewards when your data is purchased. Third-party applications and sites access BIGtoken to learn more about their consumers and earn revenue from data sales made through their platforms.

There are three main buckets of identifiers:

#1 – Bucket A: Partner and time stamp encrypted, which is helpful for capturing revenue for the provider.

#2 – Bucket B: Partner specific encryption. Think UID 2.0 in the US (not yet available in the EU), and NetID in Germany. The design is focused on user privacy protection.

#3 – Bucket C: Unencrypted IDs. The other reason for an unencrypted ID is that the provider wants to give the internet a transactable currency. If you leave it unencrypted, then maybe it’ll drive usage.

The full list of identifiers observed in the European bidstream:

33across.com

adnxs.com

adobe.com

adserver.org

aol.com

beeswax.com

britepool.com

criteo.com

id5sync.com

identityLink (LiveRamp)

invibes.com

krux.com

mediamath.com

netid.de

neustar.biz

parrable.com

pubcid.org

pubcommon

pubmatic.com

quantcast.com

rubiconproject.com

sharedid.org

smartadserver.com

sovrn.com

tdid

uidapi.com

zeotap.com

yahoo.com

Now you have a front-row seat to the tracker and we’ll keep an eye on these trends week to week. I think we can all agree that it will be interesting to revisit a few months from now to see how the tides are turning.

We expect to see more techniques that are preparation for the big cookie apocalypse, similar to what we’re seeing with pubcid.org and publishers using multiple identifiers per page.

Accordingly, we expect to see some movement in data volumes amongst the identifier providers. The top 5 by volume probably won’t change in the near term, but the next 10 could see some movement.

If you’re ready to have a conversation about including Roqad’s graph in your identity spine, give us a shout.

References

https://docs.prebid.org/overview/intro-to-header-bidding.html

https://github.com/prebid/Shared-id-v2

https://www.publift.com/blog/bidstream-data

Sign up for ID Tracker updates…